Dear Reader,

Earlier this week, Chinese EV maker NIO live streamed a record-setting 14-hour road trip, piloted by company founder and CEO WIlliam Li, across Eastern China.

The drive covered just under 650 miles and gave the NIO ET7 large sedan the crown for the longest ranged mass produced electric vehicle on the road today.

This achievement, which also unseated the Lucid Air as the reigning champion of long range, was made possible by a novel new battery pack featuring semi solid state battery cells (SSB).

You can read up on this all you want online, as the articles covering this story are abundant.

I’m here to tell you that the cutting edge battery pack, which powered the ET7 through its 14 hour 1 minute road trip, is already obsolete. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

That’s right. This semi solid state battery that William Li swapped into his car before leaving Shanghai has already gone the way of the compact disc, the cassette tape, and the vinyl record.

Because right now, there is a battery technology in development in Australia which makes these incremental steps forward minor by comparison.

Semi Solid State? That’s Small Potatoes

Here are a few numbers on this new battery technology to illustrate my point:

- Ranges exceeding 1000 miles.

- Overall battery life of one million miles or greater.

- Charge times down to less than two minutes.

Had Li been armed with this technology for his trip, he wouldn’t have needed to swap out his battery pack in Shanghai at all, as a 0-100% charge would have taken less time.

After that, he would have had enough power to drive for a full 24 hours, covering almost twice the distance.

It’s a good thing the ET7 comes equipped with NIO’s Advanced Driver Assistance System, which would have been necessary for a full day and night behind the wheel.

These new Australian batteries aren’t just an improvement on today’s lithium ion standard, but a leap to the next level, with the charge speed alone constituting a game changer for the distributed energy storage industry.

So what makes these magical batteries operate?

The answer is: Graphene.

200 Times Stronger Than Steel. Light As A Feather

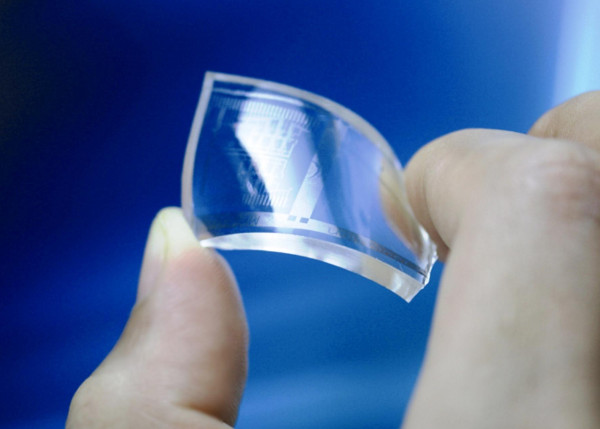

That space-age single molecule-thick nanostructure you’ve probably been hearing more and more about lately is at the heart of this new generation of batteries.

With unprecedented electrical and thermal conductivity and strength, graphene is likely to become one of the most important technological materials of the 21st century. So it shouldn’t come as a surprise that it finds one of its most compelling applications in battery technology.

The company developing these batteries also has a high-speed, low-cost method for producing the underlying graphene itself.

A decade ago, it cost more to produce this than gold.

Today, thanks to this new manufacturing methodology, it can be made in enough quantity to sustain commercialization.

Right now, as you read this, this Brisbane-based company is already putting out its first production batches of coin and pouch cells.

Corporate clients are testing these experimental batteries to see if they deliver on their promises.

Once that testing is complete, it will begin full-scale commercial production.

Soon enough, as the company diversifies its product lines, the holy grail of battery applications will come: the electric vehicle market.

The Last Piece Of The Graphene Puzzle

Once that happens, it’s very likely that graphene batteries will start pushing out all other heirs of the lithium ion throne out of the market.

That’s a market projected to be worth more than a quarter trillion dollars per year by the end of the decade.

Today, the company creating these batteries is valued at barely $150M.

Starting to see the real potential here?

I’ve been following this company closely for more than a year now, and I’m absolutely amazed by the innovations they’re about to bring to market.

I’m also amazed by how oversold the stock is of late — a victim of the downturn in the tech market.

But the bargain prices won’t stick around forever. In fact, I’m willing to bet that once tax loss selling ends in 6 more trading sessions, shares are going to start ticking upwards.

Everyone I tell this story to wants to know everything there is to know about the company. So I decided to make it easy on myself and put together a presentation that delivers all the facts and figures in a quick, efficient format.

Want to see it for yourself?

Enter here for instant access.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.